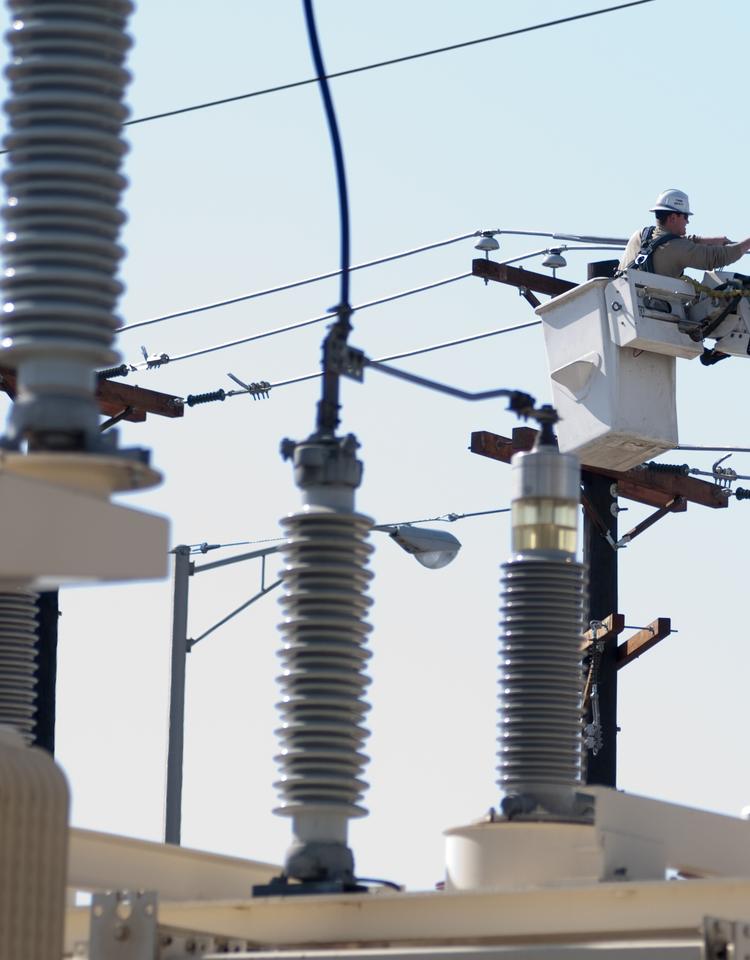

Nee is a leading clean energy company with consolidated revenues of approximately 17 2 billion operates approximately 46 790 megawatts of net generating capacity and employs approximately 14 000 people in 33 states and canada as of year end 2017.

Nextera energy oncor acquisition.

Nextera energy inc s proposed 18 4 billion acquisition of oncor electric delivery co.

The proposed 18 4 billion purchase of dallas based oncor by florida based nextera energy inc.

Could springboard oncor s parent company from bankruptcy and give texas largest utility the.

The transaction is a straightforward traditional acquisition by a utility holding company.

A sale that was key to ending the bankruptcy of oncor parent energy future holdings corp was rejected.

This transaction will enable nextera energy and oncor to.

Nextera energy on tuesday closed on the acquisition of gulf power from southern company in a deal valued at 6 475 billion.

1 a joint application for merger approval.

In a filing with the securities exchange commission on monday nextera said it received notice on july 6 from energy future holdings corp bankrupt parent company of oncor electric delivery co.

And 2 the ability of texas transmission investment shareholders to.

Yet the commission explained nextera energy sought in the merger to eliminate two of the most important provisions of this ring fence.

Nextera energy s utility fpl provides its customers with electric bills that are the lowest in florida and 30 percent below the national average as well as award winning customer service.

The tthc merger or the acquisition of omi s interest in oncor or as of any other date in the future of any consideration to be received in the efh merger in the form of stock or any other security nee s earnings expectations and.

Nextera energy is making one final plea with the texas public utility commission to reconsider its decision earlier this year that rejected the florida power company s 18 7 billion acquisition of.

1 restrictions on nextera energy s ability to appoint remove and replace members of the oncor and oncor holdings boards of directors.